Rule 23 of the GST Rules allows taxpayers to request the restoration of their cancelled GST registration.

Form GST REG-21: Application for Reversal of GST Cancellation

If a GST officer cancels your registration, you can request to get it back by filing Form GST REG-21. This form must be submitted within 30 days of the date you received the cancellation order.

If your GST registration was cancelled because you did not file your GST returns, you can file Form REG-21 only after submitting all the pending returns and paying any interest or late fees due.

Follow the steps below to file GST REG-21 for revocation of GST registration:

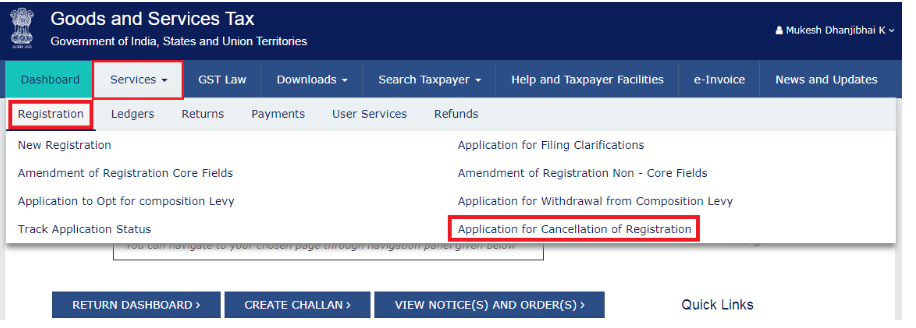

Step 1: Log in to the GST Portal

Go to the GST portal, log in with your credentials, and go to ‘Services’ > ‘Registration’ > ‘Application for Revocation of GST Registration Cancellation’.

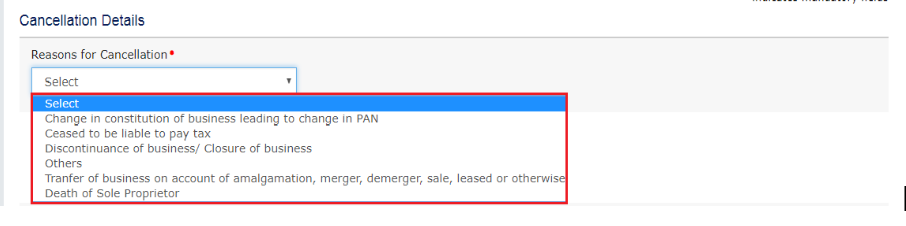

Step 2: Fill in the Details

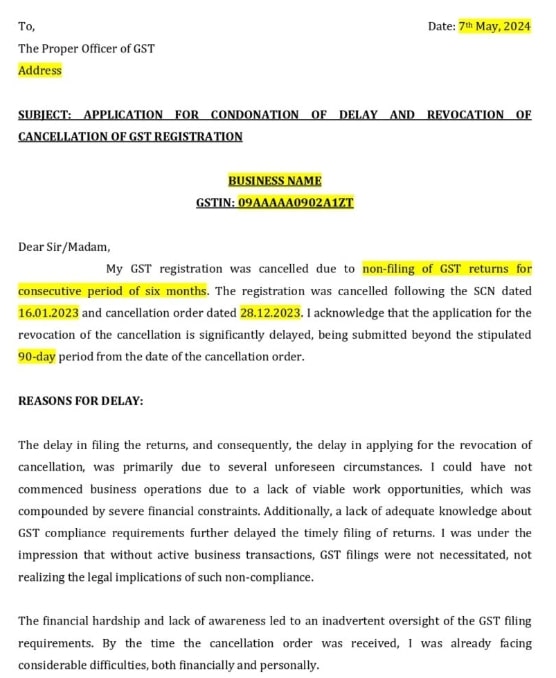

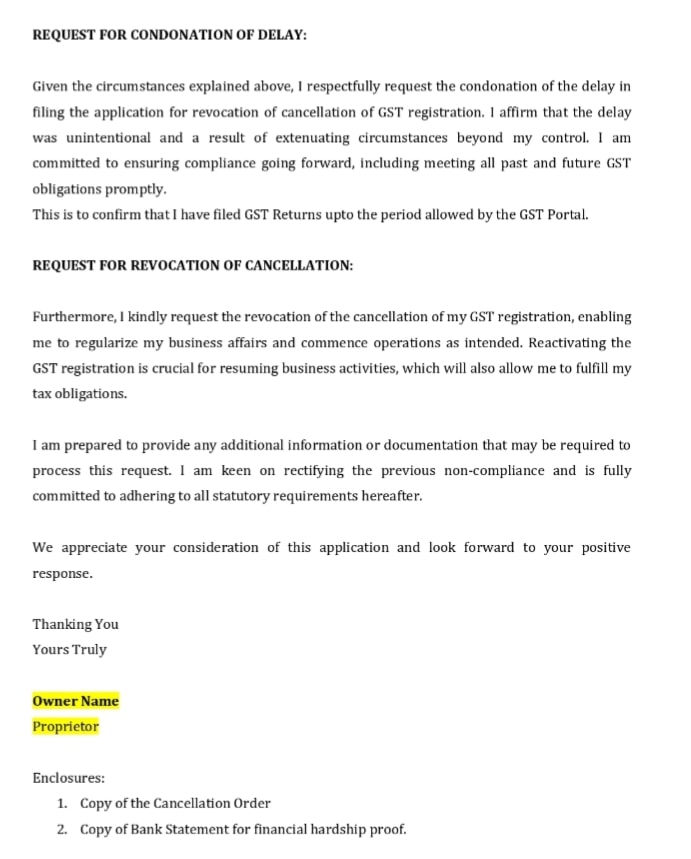

Enter the required details and mention the reason why your GST registration should be restored.

You can also attach any supporting documents, if needed.

Once all the information is filled in, tick the verification checkbox, choose the authorised signatory and place, and move to the next step.

Step 3: Submit the Application

File Form GST REG-21 using either your Digital Signature Certificate (DSC) or Electronic Verification Code (EVC).

Once submitted, you will get a confirmation message saying that your application has been successfully filed.

Form GST REG-23: Notice for Cancellation of Revocation Application

This form is issued by the GST officer when they are not satisfied with the revocation application submitted by the taxpayer whose GST registration was cancelled. It acts as a show-cause notice, giving the taxpayer an opportunity to explain why the revocation should not be rejected.

- Purpose: To notify the taxpayer that the application for revocation of cancellation is being considered for rejection.

- Response Time: The taxpayer must respond within 7 working days from the date of issue.

Form GST REG-24: Reply to Show-Cause Notice (REG-23)

If a taxpayer receives a notice in Form REG-23, they must submit their reply through Form REG-24. This form allows the taxpayer to present their justification, provide additional documents, and explain why the revocation application should be accepted.

- Purpose: To reply to the officer’s concerns raised in REG-23.

- Deadline: Must be filed within 7 working days from the date of the REG-23 notice.

Last Update: The government had allowed a one-time extension under Notification No. 03/2023 for taxpayers whose GST registration was cancelled on or before 31st Dec 2022. They could apply for revocation until 30th June 2023 after filing pending returns and clearing dues.

Who Else Can Apply Under This Extension?

The following taxpayers can also apply for revocation under this extended window:

- Those whose appeal against cancellation was rejected due to late filing.

- Those whose appeal against the rejection of the revocation application was dismissed due to time limits.

CBIC Circular on Extended Revocation Period

The CBIC issued Circular No. 158/14/2021-GST on 6th September 2021 to explain the earlier extension given under Notification No. 34/2021 dated 29th August 2021.

- This allowed taxpayers whose revocation deadline expired between 1st March 2020 and 31st August 2021 to apply for revocation by 30th September 2021.

- Many taxpayers were confused about whether they could apply again if their previous application was rejected, in process, or an appeal.

The circular clarified that the relief applies to all such cases, regardless of whether the revocation application was:

- Already applied

- Under review

- Rejected

- With appellate authority